Wholesale Energy Prices Explained

Energy pricing is one of those subjects that many like to hide behind complexity as a reason to fail to explain how this works and what impact it has on Tasmanian energy prices. But once you strip away the jargon, the way wholesale electricity prices are set is surprisingly straightforward. Understanding it is crucial, because the decisions being made right now on interconnection projects like Marinus Link will reshape what Tasmanians pay on their bills for decades to come.

How Wholesale Prices Are Set

Australia’s National Electricity Market (NEM) covers the eastern states, including Tasmania and Victoria. Here’s how the wholesale price works:

- Every five minutes, generators (hydro, coal, wind, solar, batteries, gas) bid into the market to supply electricity.

- The bids are stacked from cheapest to most expensive until demand is met.

- The final (marginal) bid that satisfies demand sets the “clearing price”.

- Every generator whose bid was accepted is paid this clearing price, even if they offered to sell cheaper.

This means the market is dominated by what happens at the margin. If coal plants are still running, they can suppress prices. If they close, and gas is needed more often, prices go up. Weather, inflows, demand swings and fuel costs all play a role.

Why Victoria and Tasmania Prices Differ

Although both states are in the NEM, they don’t always share the same wholesale price. The reason is simple: limited interconnection capacity.

- Basslink, the current cable, can carry only so much power between the two markets. When demand to export or import exceeds its capacity, the markets “separate.”

- At those times, Tasmania and Victoria can have very different wholesale prices.

- If Tasmanian hydro is abundant (say, after good rains), Tas prices can fall well below Victoria’s. Hydro Tasmania (HT) can then export into Victoria at a profit.

- Conversely, in drought years, when hydro is scarce, Tas prices can spike higher than Victoria’s.

In short: interconnection limits are what allow Tasmanian prices to be different from Victoria’s.

The Current Situation

Right now, Tasmania tends to sit just below Victoria in wholesale prices on average, because Hydro’s zero-fuel-cost energy is competitive. But this margin is narrowing.

- Victoria: Prices are rising as coal plants age and exit, with gas increasingly called on to firm supply when renewables aren’t available.

- Tasmania: Prices remain influenced by hydro inflows, and over time, additional renewable energy resources.

What Marinus Link Changes

Marinus Link, the planned second and third interconnectors, changes everything. It would roughly triple the transfer capacity between Tasmania and Victoria. With that much connectivity, wholesale prices between the two states will converge.

The theory is that Tasmanian prices will fall initially because Hydro and new renewables will supply more power into Victoria, lowering the marginal clearing price there. But the longer-term reality is more complicated.

The Coal Exit Effect

Victoria is on the front line of Australia’s coal exit. As power stations shut, the NEM will increasingly rely on gas and batteries to firm renewable supply. Gas is expensive. That means wholesale prices in Victoria will rise sharply over the next two decades.

With Marinus in place, Tasmania’s prices will be pulled upward to meet Victoria’s. In effect, Tasmanians will inherit Victoria’s higher costs.

The Convergence Dynamic

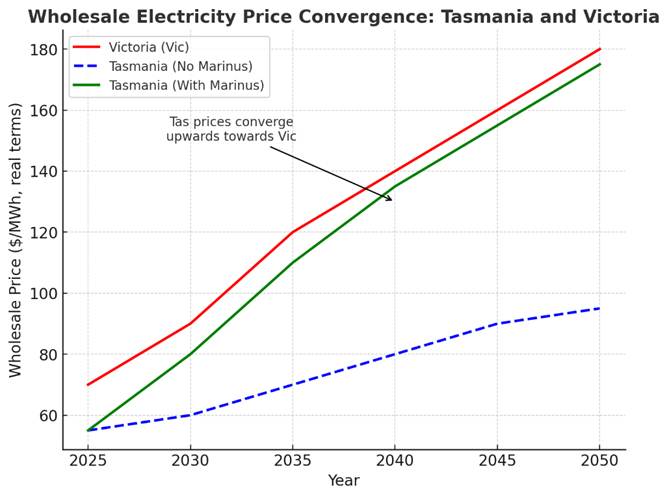

To put this more simply:

- Without Marinus: Tasmanian wholesale prices rise gradually, but remain partly insulated, tracking below Victoria’s.

- With Marinus: Tasmanian prices converge upwards, rising much faster, until they sit close to Victoria’s higher wholesale price level.

The AI generated diagram below illustrates this.

What It Means for Consumers

For households and small businesses, this isn’t an academic debate. It shows up in bills.

- The Marinus Whole of State Business Case (WoSBC) suggested Tasmanian households might save $71 a year from Marinus (through lower wholesale costs offsetting transmission charges).

- But when you factor in convergence with Victoria’s rising prices, Tasmanians are looking at net increases of around $449 per household per year.

- For small businesses, the story is worse: a net increase of about $1,128 annually.

In other words, whatever local benefits Marinus delivers are swamped by the NEM-wide trend of rising wholesale prices.

What It Means for Hydro Tasmania

- Hydro profits are expected to increase substantially under Marinus, as it arbitrages Tasmanian hydro into a tightening Victorian market.

- These profits underpin the “rivers of gold” narrative promoted by the government- because higher Hydro dividends would flow into state coffers.

But there is a catch: those same higher wholesale prices that boost Hydro profits are what Tasmanian consumers will be paying on their bills. To soften the political blow, much of Hydro’s profits will need to be recycled into subsidies to offset higher prices.

The impact could be compounded as here’s where the risk comes in: everything depends on Hydro actually capturing those profits.

What happens if Hydro Tasmania fails to lock in the revenue streams that Marinus assumes?

- If new renewable projects are delayed, or contract prices are poorly negotiated, Hydro may not have the volume to fully exploit the Marinus pipeline.

- If inflows decline, or if unexpected market changes reduce wholesale prices, the projected profits may not materialise.

- If Hydro’s contracting strategy is outplayed by mainland retailers and generators, it could be squeezed on margins.

Meanwhile, Tasmanians are still stuck with:

- Higher wholesale prices, pulled up by Victoria’s coal exit.

- Higher transmission charges, which are regulated and unavoidable.

That’s the nightmare scenario: consumers paying more, while Hydro fails to generate the promised windfall. The “rivers of gold” turn into a mirage, leaving Tasmanians carrying the costs without the offsetting benefits.

And given the government’s record on major projects—where timelines slip, budgets blow out, and benefits are overstated, I don’t believe it is alarmist to say the risk here is huge.

The Irony of Marinus

Whilst Marinus opens up opportunity for additional renewable energy, the irony couldn’t be sharper:

- Tasmanians pay more for electricity as their wholesale prices converge with Victoria’s.

- Hydro Tasmania earns more by selling into Victoria’s higher-priced market.

- The Tasmanian Government uses Hydro’s profits to subsidise Tasmanians, trying to neutralise the very bill increases created by the project in the first place.

- If Hydro stumbles, the subsidies vanish—leaving only higher bills and locked-in transmission charges.

It is, in effect, a circular subsidy system.

The Takeaway

Wholesale energy prices are simple in principle but profound in impact. With limited interconnection, Tasmania could remain partly insulated from the big swings in Victoria’s market. With Marinus, that insulation disappears.

For Tasmanian consumers, this means higher bills. For Hydro Tasmania, it means higher profits. And for the Government, it means balancing the books by using Hydro’s profits to subsidise the households and businesses hit hardest.

Hydro Tasmania must perform flawlessly in capturing profits to subsidise consumers and support the budget. If it fails, Tasmanians will be left with the worst of all worlds—higher bills, higher network costs, and none of the promised upside.

The question is whether this cycle is truly sustainable – or whether it simply locks Tasmanians into paying more, while the mainland enjoys the lion’s share of the benefits.