Over the next three weeks, I will continue posting a new post daily, or thereabouts, related to how Hydro Tasmania actually earns money, how the National Electricity Market shapes its fortunes, and why the numbers in its accounts now matter more than at any time in the past two decades. It also seeks to dismantle the myths that have dominated public debate.

This sixth post provides details about how the Large Generation Certificates (LGCs) impact on Hydro’s finances in the past, present and future. There are 18 Chapters in total. I thank John Lawrence for his assistance in preparing this information, his attention to detail and research over many years as we have worked together to better understand one of the most complex areas that impact our state, economically and functionally.

Glossary of acronyms used in this chapter

AEMO – Australian Energy Market Operator: Runs the NEM, dispatches generators, manages system security, and publishes key planning documents.

GWh – Gigawatt‑hour: A measure of energy. One GWh equals one million kilowatt‑hours or one thousand megawatt hours.

IRR / IRRs – Inter‑Regional Revenues / Inter‑Regional Residues: The financial mechanism that captures price differences between NEM regions.

LGC – Large‑scale Generation Certificate: A renewable energy certificate created for each MWh of eligible renewable generation.

MW – Megawatt: A measure of power (capacity). One MW equals one thousand kilo watts.

NEM – National Electricity Market: A collection of five separate regional markets linked by interconnectors.

PPA – Power Purchase Agreement: A contract to buy or sell electricity at an agreed price.

RRP – Regional Reference Price: The official price for each NEM region. Tasmanians pay the Tasmanian RRP.

RET – Renewable Energy Target: Australian government scheme to incentivise 33,000 GWh electricity from renewable sources each year from 2020 to 2030.

WWF – Woolnorth Wind Farms: Built by Hydro but now owned 75 per cent by Shenhua Clean Energy and 25 per cent by Hydro. Operates wind farms at Bluff Point, Studland Bay and Musselroe – a total of 308MW of installed capacity.

Chapter 6: LGCs – The $142 Million Problem Hidden in Plain Sight

How Hydro’s long‑term renewable contracts turned into a loss – and why the losses will continue until 2030.

Hydro Tasmania’s 2024–25 Annual Report contains a number that should have set off alarms across the state. It sits quietly in Note 17, under the bland heading “onerous contracts”. The number is $142 million – the present value of losses Hydro expects to incur on its renewable energy contracts until 2030.

These losses come from one source: Large‑scale Generation Certificates (LGCs). And in 2024/25, the losses exploded – not just because Hydro is locked into buying LGCs at $50 each, but because the market price collapsed by half, forcing Hydro to write down the value of its existing LGC inventory.

This is the part no one has explained publicly.

Why Hydro Does Not Generate LGCs From Its Own Hydro Stations

Under the Renewable Energy Target (RET), hydro generators only receive LGCs for generation above a defined baseline – roughly 8,600 GWh for Hydro, with individual baselines for each power station.

In both 2023/24 and 2024/25:

- Hydro generation was well below the baseline

- Storages were low

- Rainfall was poor

The result is simple: Hydro generated virtually no LGCs from its own assets in either year. As far as we can tell. If they did it would be commercial in confidence.

Its entire LGC position comes from wind farm PPAs, not from hydro production.

Where Hydro’s LGCs Actually Come From

Hydro’s LGCs come from two contracted sources:

- Granville Harbour Wind Farm

- Woolnorth Wind Farms (Bluff Point, Studland Bay, Musselroe)

Together, these wind farms generate around 1.35 million LGCs per year, all of which Hydro must purchase – regardless of market price.

This is the structural trap Hydro is now caught in.

The Market Collapsed – and Hydro’s Inventory Was Hit Hard

When Hydro signed its PPAs in the 2010s:

- LGC prices were sometimes above $80

- A fixed purchase price of ~$50 looked prudent

But by 30 June 2025, LGC prices had collapsed to around $21. The average for the year was around $22 – roughly half the previous year’s level.

This collapse had two effects:

1. Ongoing losses on new LGC purchases

Hydro continued buying LGCs at $50 and selling them at around $22.

2,A forced write‑down of existing LGC inventory

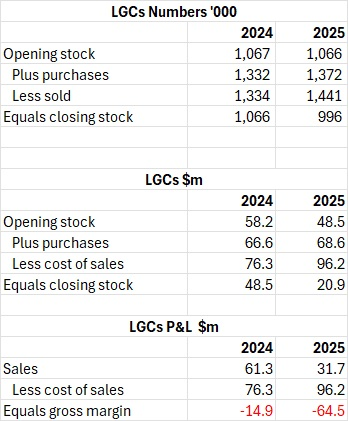

Hydro’s closing stock fell from $48.5 million to $20.9 million – a $27.6 million write‑down.

This write‑down is the hidden reason why the 2024/25 loss was so much larger than the year before.

The Numbers Hydro Never Publishes – But Cannot Hide

Using Hydro’s Note 11 disclosures which include a dollar figure for unsold LGCs at balance date (inventory on hand), Clean Energy Regulator data on LGC prices, and wind farm output, we can reconstruct Hydro’s LGC flows.

Across two years, Hydro lost $79.4 million on LGCs.

But the key point is this: The 2024/25 loss was far larger because the LGC price halved, forcing Hydro to write down its entire inventory – on top of the losses from ongoing purchases.

This is the part the public has never been told.

The Forward Losses: Why the $142 Million Provision Makes Sense

Hydro receives around 1.35 million LGCs per year under its Power Purchase Agreements (PPAs). At a contract price of $50, that implies: $67.5 million in annual cost. At a market price of $22, Hydro recovers $29.7 million in annual revenue. The annual loss is therefore: $38 million per year

The contracts run until 2030. Over the next five years, if prices remain around $22, Hydro will lose:

- $28 per LGC

- on 1.35 million LGCs per year

- for five years

Total nominal loss: $182 million discounted to present value: $142 million – this is exactly the provision Hydro has recorded. Hydro’s own financials confirm the impending losses.

Why This Matters for Hydro – and for Tasmania

These losses:

- reduce Hydro’s underlying profit

- reduce dividends and tax equivalents

- reduce Tasmania’s own‑source revenue

- increase Hydro’s reliance on debt

- weaken Hydro’s ability to support new renewables

- undermine the financial case for Marinus

- expose the fragility of Hydro’s contract portfolio

In 2024/25, Hydro’s underlying profit was already negative. Without the $100+ million Inter-Regional Revenue (IRRevenue) windfall, the loss would have been catastrophic.

LGC losses are now a permanent drag on Hydro’s finances.

Why this matters

Hydro’s LGC problem is not a footnote. It is a structural, long‑term financial liability that will cost Hydro – and therefore Tasmania – around $182 million over the next five years.

And the 2024/25 result shows the danger clearly:

When LGC prices fall, Hydro doesn’t just lose money on new purchases – it must write down its entire inventory. That is why the 2024/25 loss exploded.

This is the second collapsed pillar of Hydro’s financial reality, alongside the loss of IRRevenues.

Next, in Chapter 7, we turn to PPAs themselves – the contracts that created this problem, why they were signed, how they work, and why they now pose a long‑term financial risk to Hydro and the State.

Postscript to Chapter 6 on LGCs

Since this chapter was drafted, the certificate landscape has shifted again – and in a way that reinforces every warning contained here. In December 2025, LGC prices collapsed to around $6/MWh, with futures markets signalling the possibility of further falls. The corporate voluntary market that once propped up LGC demand has evaporated, and the Commonwealth’s Capacity Investment Scheme (CIS) has removed any expectation that the original Renewable Energy Target (RET) might be extended. The Guarantee of Origin reforms have diluted the market further by allowing pre‑1997 “below‑baseline” generation into the system.

For developers, this collapse makes merchant strategies riskier and financing harder. For Hydro, the implications are even more direct. The fixed‑price PPAs described in this chapter were already onerous when LGCs traded at $22. At $6, the gap between Hydro’s contracted purchase price and market value is now wider than at any point since the RET began. The remaining years of these contracts will be even more costly than previously anticipated.

Let’s be frank about what a $6 LGC price means for the next 5 years. It means cash losses of $66 million per year.

This is the backdrop to Chapter 8, where Renewable Energy Guarantees of Origin (REGOs) emerge as the new certificate instrument in a post‑RET world. But the lesson from LGCs – and from the CIS reshaping the economics of renewable development – is clear. Certificates are no longer a revenue stream. They are no longer a hedge. They are no longer a subsidy. Under the CIS, developers no longer need high‑priced certificates to make projects bankable, and REGOs will never carry the financial weight LGCs once did.

But first in Chapter 7 we’ll take a closer look PPAs themselves – the contracts that created this problem.