Over the next three weeks, I will continue posting a new post daily, or thereabouts, related to how Hydro Tasmania actually earns money, how the National Electricity Market shapes its fortunes, and why the numbers in its accounts now matter more than at any time in the past two decades. It also seeks to dismantle the myths that have dominated public debate.

This forth post provides details about how the National Electricity Market (NEM) works for Tasmania. There are 18 Chapters in total. I thank John Lawrence for his assistance in preparing this information, his attention to detail and research over many years as we have worked together to better understand one of the most complex areas that impact our state, economically and functionally.

Glossary of acronyms used in this chapter

AEMO – Australian Energy Market Operator: Runs the NEM, dispatches generators, manages system security, and publishes key planning documents.

APA – Owner of Basslink

IRR / IRRs – Inter‑Regional Revenues / Inter‑Regional Residues: The financial mechanism that captures price differences between NEM regions. Historically a major windfall for Hydro.

MW – Megawatt: A measure of power (capacity). One MW equals one million watts

MI – Major Industrials: There are four – Bell Bay Aluminium, Temco, Nyrstar and Norske Skog who consume 55 per cent of the State’s electricity via contracts with Hydro.

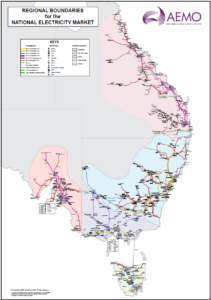

NEM – National Electricity Market: A collection of five separate regional markets linked by interconnectors.

RRP – Regional Reference Price: The official price for each NEM region. Tasmanians pay the Tasmanian RRP.

Chapter 4: How the NEM Really Works for Tasmania

Hydro’s Role, Money Flows, and the Changing Economics of Basslink

Electricity in Tasmania is not just a technical system. It is a financial system, a political system, and increasingly a fiscal lifeline. To understand Hydro Tasmania’s fortunes – and the State’s – you need to understand how the National Electricity Market (NEM) works from Tasmania’s vantage point. Not the mainland version. Not the political version. The Tasmanian version.

And to understand that, you need to understand Basslink – the cable that has shaped Hydro’s revenue for two decades, and whose economics changed dramatically on 1 July 2025.

This chapter sets out, in plain English, how the NEM actually works for Tasmania, how money flows through the system, and why the shift from a Hydro‑influenced Basslink will have dramatic consequences.

The shift from Hydro‑influenced Basslink to APA‑controlled Basslink – and soon to regulated Basslink – is the most consequential changes for Tasmania’s electricity system in the last 20 years.

The NEM in simple terms – the five‑minute auction that sets everything

The NEM is not a trading floor where Tasmania “buys” electricity from Victoria or “sells” electricity to Victoria. It is a continuous auction that runs every five minutes.

Generators bid how much they can produce and at what price. Australian Market Energy operator (AEMO) stacks those bids from cheapest to most expensive. Demand is matched with the cheapest available supply. The price paid to all generators in a region is the price of the last generator needed to meet demand.

That price is the Regional Reference Price – the RRP.

Tasmania has its own RRP. Victoria has its own RRP. They are linked – but not merged – by Basslink.

When Basslink is unconstrained, prices tend to converge. When it is constrained, prices diverge. And when prices diverge, money is made – or lost.

When Basslink is idle – the “closed” Tasmanian system

When there are no imports or exports, Tasmania becomes a closed market.

Hydro bids its generation. Wind farms bid theirs. Solar contributes when it can. Aurora and the major industrials (MIs) pay the Tasmanian RRP for their load.

Hydro earns Tasmanian RRP for every megawatt hour it generates. It also receives contract payments from major industries (MIs) under long‑standing bilateral agreements. And it pays AEMO Tasmanian RRP for the MI load it is contractually responsible for.

In this scenario, Hydro’s margin is determined by:

- the Tasmanian price

- its contract terms

- its water availability

There are no inter‑regional revenues/residues (IRRs) because Basslink is not moving power.

This used to be the least common scenario – until 30 June 2025, when Hydro lost control of Basslink. Since then Basslink has been idle almost half the time.

When Tasmania exports – and why it used to be lucrative

Exports occur when Tasmanian prices are lower than Victorian prices.

Before 1 July 2025 – Hydro’s arbitrage era

Hydro controlled Basslink’s bidding. It bid its generation at $0/MWh. If Victoria’s price was higher, Basslink flowed north.

Example: Tasmanian RRP = $40 Victorian RRP = $60 Basslink exports.

Hydro earned:

- $40/MWh for its generation, plus

- the $20/MWh price difference – the IRR

Hydro’s effective revenue was $60/MWh.

This was not a rounding adjustment. It was worth tens of millions of dollars a year. In 2024/25, exports earned $54 million. Imports earned more than twice that. Arbitrage revenue masked Hydro’s underlying losses.

After 1 July 2025 – APA takes control of Basslink

Hydro no longer controls Basslink. APA does. APA sets the interconnector bid price. APA captures the IRR. Hydro earns Tasmanian RRP only.

Same example: Tasmanian RRP = $40 Victorian RRP = $60 Basslink exports.

Hydro earns $40. APA earns the $20. Hydro’s revenue shrinks dramatically.

Once Basslink becomes regulated

From July 2026, Basslink is set to become a regulated transmission asset.

IRRs will then be:

- auctioned, or

- redistributed under AEMO’s rules

Hydro will not receive them unless it pays for them.

The arbitrage era is over.

When Tasmania imports – and why Hydro is now exposed

Imports occur when Tasmanian prices are higher than Victorian prices.

Before 1 July 2025 – IRRs softened the blow

Example: Tasmanian RRP = $60 Victorian RRP = $40 Basslink imports.

Aurora and the MIs pay AEMO $60. AEMO pays Victorian generators $40. The $20 difference – the IRR – went to Hydro. This mattered because Hydro is contractually responsible for MI load. Hydro paid AEMO $60 for MI consumption – but received $20 back via IRRs. The IRR cushioned Hydro’s exposure.

After 1 July 2025 – the cushion disappears

APA now receives the IRR. Hydro still pays AEMO $60 for MI load. But Hydro receives no offset. Hydro must absorb the full difference between contract prices and Tasmanian RRP.

Once Basslink is regulated

Hydro remains exposed unless it buys IRRs at auction. This is a major structural shift. MI contracts – once supported by IRRs – now carry real risk.

Hydro’s position across all scenarios – the new reality

When Basslink is idle: Hydro earns Tasmanian RRP for generation and pays Tasmanian RRP for contracted load.

When exporting:

- Before July 2025: Hydro earned RRP + IRRs

- After July 2025: Hydro earns RRP only

- Regulated: Hydro earns RRP only

When importing:

- Before July 2025: Hydro paid RRP but received IRRs

- After July 2025: Hydro pays RRP with no offset

- Regulated: Same as after July 2025 – no offset

Hydro has lost:

- its arbitrage upside

- its import‑side cushion

- its privileged access to IRRs

This is one of the most significant financial changes in Hydro’s history – and it has barely been acknowledged publicly.

The contract overlay – the quiet risk no one is talking about

Hydro’s bilateral contracts with major industrials are central to Tasmania’s economy. These contracts were financially sustainable when IRRs existed to cushion Hydro’s exposure.

Now:

- Hydro pays AEMO Tasmanian RRP for MI load

- Hydro receives no IRR offset

- Hydro must absorb the difference between contract prices and spot prices

This means:

- Hydro’s margins are thinner

- Hydro’s risk is higher

- MI contracts may need to be repriced

- Tasmania’s industrial base is more exposed than anyone has admitted

The loss of IRRs is not just a Hydro problem. It is a whole‑of‑economy problem.

Why this matters

Hydro’s revenue model has changed. Basslink’s economics have changed. Tasmania’s exposure has changed.

But the public narrative has not.

Understanding these money flows is essential to understanding:

- Hydro’s declining profitability

- The $100+ million IRR windfall that financially saved Hydro in 2024/25

- The disappearance of that windfall

- The fragility of MI contracts

- The risks of Marinus

- The State’s fiscal vulnerability

This is the real NEM story. This is the Tasmanian story, and it is the foundation for everything that follows.

Next, in Chapter 5, we turn to Inter‑Regional Revenues/Residues (IRRs) themselves: what they are, how they work, why they mattered so much to Hydro, and why their disappearance is a turning point for the State.