The unheralded lodgement of TTLine’s financial statements for the 24/25 year a little earlier than expected was a mixed blessing.

On one hand it was pleasing to see the new Board clearing the decks, if you’ll forgive the nautical pun.

On the other hand, things are a lot worse than anyone ever imagined. TTLine’s problems aren’t just a matter of cost overruns and design flaws with the new ferries and the monumental cost underestimates and unforgivable planning delays for Berth 3 in Devonport. Operating losses are now being experienced. This doesn’t include any expenses relating to the new ferries or the new Devonport berth. These are yet to impact TTLine profits.

The 2025 financials painted a bleak picture. But it was hard to imagine it suddenly happened. How long has it been going on?

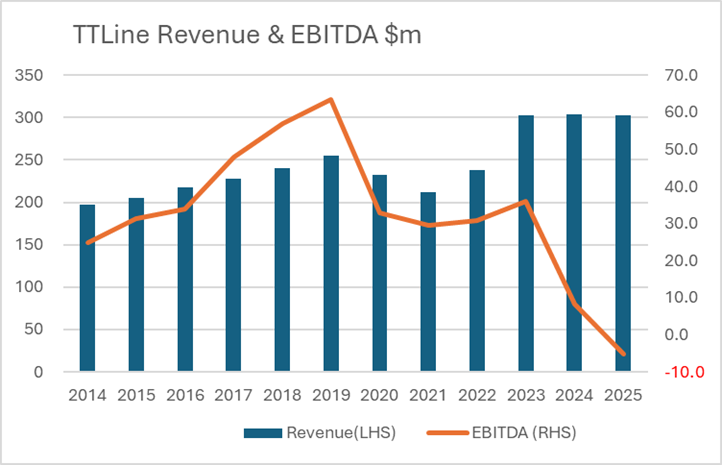

The following chart tells the sorry tale. It’s a chart showing movements in revenue over the past 12 years and movements in cash earnings (EBITDA), the net amount from operations required to pay interest, pay for capex outlays such at new items of plant and the cyclical maintenance required by large ships, and to make loan repayments.

In the pre Covid years EBITDA grew faster than revenue reaching $69 million the year Covid struck in 2020. Revenue from customers was $230 million in the year Covid struck (2019/20), down a little from $255 million in the previous year.

Revenue and EBITDA bottomed in 20/21 at $212 million and $30 million respectively.

In the last three years, revenue climbed to around $300 million pa, well above pre Covid levels although it has now noticeably flatlined.

But EBITDA has gone in the other direction and returned a negative number in 24/25 – negative $4 million. In that year TTLine had to find $1 million to pay interest on its overdraft, $6 million for minor items of plant and $9 million for major cyclical maintenance on the existing ferries. These usually come out of EBITDA, but it was negative already. Which of course meant that interest on the loan to fund the new ferries and Berth 3 had to be borrowed as well. A total of $47 million of interest was paid on this loan which had climbed to $865 million by June 2025.

The government announced today it had agreed to make an equity contribution of $75 million into TTLine as part of the upcoming 25/26 budget.

On everything we have seen so far, that will make little difference. It won’t make TTLine sustainable. It may pay the bills for a year. It’s a band aid solution to problems we’re now seeing in full gory technicolour. It will certainly raise doubts in many minds whether the government is capable of overseeing these large infrastructure projects. It’s difficult to see how the government didn’t know more and should have acted much sooner. If you were scoring the government out of ten, it would like TTLine’s EBITDA – it would be negative.

There are many questions that still need to be asked and answered.

Postscript

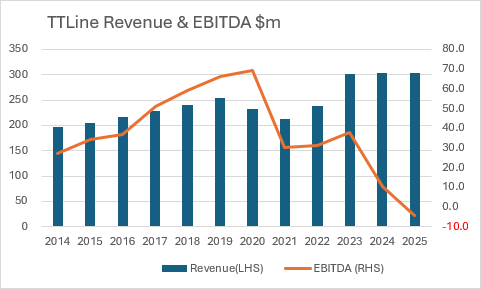

The above EDBITDA calculations for the period 2013/14 to 2024/25 contain small amounts of interest received ($1m to $2m pa) which slightly overstate the figures. In 2019/20 a windfall foreign exchange gain of $36 million in 2019/20 definitely distorted the EBITDA for that year. Amending the EBITDA calculations to exclude investment revenue doesn’t alter the trends as evidenced in the following updated chart: