Election Update number 17: Hydro Tasmania and Marinus

Both major parties agree we have a problem. The Liberals tell us they have a 2030 Strong Plan to tackle it and Labor have proposed a Fresh Start Strategy.

Whenever the Premier appears in public, he has a copy of the 2030 Strong Plan tucked under his arm, but it can’t be found on-line. Is it the same document as his now abandoned 25/26 Budget? We can only speculate.

On Friday 11th July the Premier released a 30-page Economic Statement to little fanfare. No mention of increased revenue. The two majors are on a unity ticket. They have ignored the overwhelming evidence that without new revenue sources our fiscal sustainability is highly problematic.

This is despite the Liberals correctly identifying a need in their now abandoned 25/26 Budget to grow own source revenue from the current disastrous position where it funds only 30 per cent of operating expenses to a level where 37 per cent is funded by us.

However they didn’t bother to tell us how it proposed to do it, only that they thought it was a good idea.

Labor didn’t even bother to give the matter any meaningful consideration.

One of the important components of own source revenue, after state taxes, are returns from government businesses. These contribute between 3 and 5 per cent of total revenue, a relatively small amount but nevertheless vital.

What we managed to glean from the 25/26 Budget before it was thrown in the bin so the dancers at the party in the House of Assembly could devote a couple of months playing musical chairs, was that a whopping $154 million in revenue had been wiped from estimated future returns from Hydro Tasmania. A prediction of a return to average rainfall in 4 years’ time was needed to prop up the sagging return from Hydro, the major contributor from government businesses in the last year of the forward estimates.

Yet both parties are proposing plunging into a $5 billion plus Marinus project, not to mention additional generation facilities, some of which will impact the Government’s balance sheet, without a clear idea of where it might take us. Specifically, how will the investments help build returns from Hydro (and TasNetworks) sorely needed to fund government services?

The Liberals’ Economic Statement says Marinus will become a cornerstone of our energy future. That’s hype of course. Hydro will continue to be the all-important cornerstone of our future, so before we decide on a possible Marinus, we need to have a better grasp of Hydro’s current situation.

Most people know what Hydro does. From its website:

Every year, we produce about 9000 gigawatt hours of clean electricity from hydropower ………. (from) 30 power stations and more than 50 major dams.

Most of our electricity needs come from hydro sources but the assets are aging. Looking after and maintaining these important assets is costly. Tasmanian consumption has been around 11,000 GWh but it has been gradually falling over the last 2 years, down to around 10,500 GWh in the latest year 2024/25, due predominantly to problems with the major industrials. NB those figures don’t include rooftop solar currently about 400 GWh pa and increasing rapidly off a low base.

It is helpful to also take an historical view of Tasmania’s energy system. Discounted rates to bulk users made economic sense when we had surplus electricity which in flow-of-the-river situations with reliable rainfall meant the marginal costs to produce much of the power was quite low and the benefits which flowed from having large industrials outweighed the costs. Things have changed. The Basslink interconnector means low cost electricity can now fetch a higher price. Power discounts can be accurately valued because an alternative market now exists. Those now seeking additional or new electricity connections, expecting this level of discounted rate are being told no – you can have the power but not at that discounted price. With lower rainfall, as described in State budget papers and Hydro reports, there’s not as much low cost electricity as occurred in the past, that can be provided to bulk users at discount prices. And not as much that can be exported chasing higher prices.

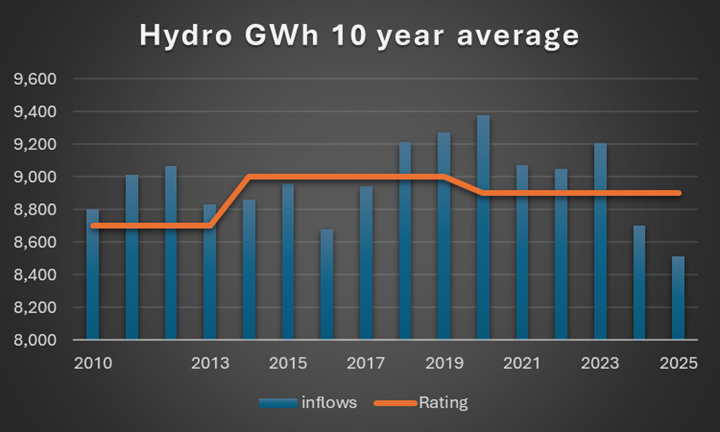

Hydro rates its hydro system as having a capacity of around 9,000 GWh each year. When it values its hydro system, which it does using estimates of future prices and future production plus a few other variables, future production is based on average inflows over the past 10 years. In recent times the rating of the system has been between 8,700 GWh and 9,000 GWh.It is currently 8,900 GWh. The hydro system is valued based on production of 8,900 GWh per year. The cornerstone of our energy future upon which Marinus is to sit atop is assumed to produce 8,900 GWh.

What has happened over the past 2 years is a far cry from that rosy picture. People may remember the millennium drought years from 2005 to 2008 (although 2006 was an above average rainfall year). The nadir was reached in 2007 with inflows of only 6,500 GWh.

But the 2023/24 year saw an even lower inflow, with only 6,200 GWh. The just completed year 2024/25 wasn’t much better, with inflows of around 6,400 GWh. Hydro production was even lower, at around 6,300 GWh, enough for only 60 per cent of our needs. Wind and Basslink imports were needed for the remainder.

The effect of these incredibly low inflow years is gradually starting to affect the 10-year average which Hydro uses to value its assets.

The chart shows the rating of the hydro system was lifted in 2014 to 9,000 GWh as the effects of the millenium drought wore off, before being lowered to its current level in 2020. With the last 2 years of inflows below 6,500 GWh, and the 10-year average falling below 8,500 GWh for the first time in living memory, it wouldn’t be a surprise to see Hydro needing to revalue its assets, update its future plans and perhaps let the people of Tasmania in on the secret before we plunge headlong into Marinus.

The Australian Energy Regulator AER has finally made a decision making Basslink a regulated asset. For all of its 20-year life it’s been an unregulated part of the National Electricity Market NEM contracted to Hydro. With Basslink becoming a regulated asset, like a toll road, the patterns of use will change and so will the impact on Hydro’s finances. How will Hydro’s profits, already trying to cope with lower inflows, be impacted? Lower profits means less available to maintain aging assets.

The ramifications are enormous, not just for Hydro’s balance sheet and what extra borrowing it can support to build the extra generation needed to justify Marinus, but also from the viewpoint of our own source revenue so vital to our future but which both major parties conspicuously avoid discussing.

Decisions this important should not be made under the cover of the caretaker period during an election and certainly not without a full understanding of all the issues and implications for Tasmania.